This article was initially featured on New Norm. Shang Residences at...

What are the tips for real estate investors to maximize ROI on rental properties?

- Choose the right location

- Invest in quality property management

- Upgrade strategically

- Offer lifestyle-driven amenities

- Optimize your rental pricing

Overview

– This article provides essential tips for real estate investors focused on maximizing ROI on rental properties.

– It highlights strategies for making smart investments that deliver long-term profitability, including choosing prime locations, investing in quality property management, upgrading strategically, offering lifestyle-driven amenities, and optimizing rental pricing.

– Shang Residences at Wack Wack (SRWW) offers a prestigious location and high-quality features.

For real estate investors, maximizing ROI on rental properties is always the ultimate goal. Whether you’re eyeing the best condominium in Mandaluyong or other prime locations, the right strategies can ensure your investment appreciates over time while generating steady cash flow through rental income.

In this article, we will explore some essential tips for real estate investors that will guide you toward maximizing the profitability of your rental properties. These tips are not just about securing the right property but about optimizing every aspect of your investment to achieve the best returns.

Choose the Right Location

You may think that location is just about the address, but it’s about the value it can bring over time. A prime location naturally attracts high-quality tenants, ensures strong resale potential, and elevates your property’s prestige.

When you want your place to be rented, being in the right neighborhood gives your investment staying power. Think about accessibility, surrounding developments, safety, and overall appeal, these factors influence how desirable your property is and how fast its value grows.

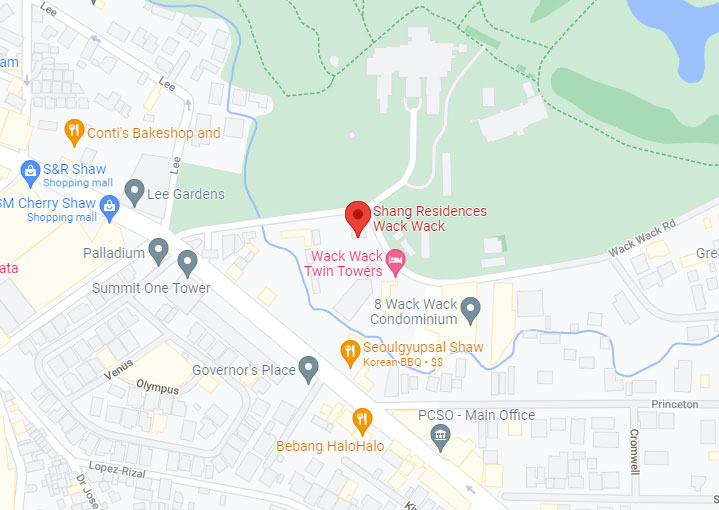

Take Shang Residences at Wack Wack (SRWW), for example. Situated along Bauhinia Drive in Mandaluyong, this address places you right in the heart of Metro Manila’s most connected locations. You’re minutes away from Ortigas Center, Makati, and BGC, with quick access to major roads and business districts. The neighborhood around Bauhinia Drive offers the rare balance of privacy and prestige, tucked away enough to give you peace, yet close enough to top-tier schools, hospitals, golf courses, and lifestyle destinations.

Invest in Quality Property Management

Property management goes beyond just collecting rent, it involves maintaining the unit, handling tenant concerns, ensuring compliance with legal requirements, and keeping your property in top shape. If you’re a busy investor or live far from your rental unit, a reliable property manager acts as your on-ground representative, making sure everything is taken care of with professionalism and efficiency.

One of the best ways to ensure this is to choose a property that already includes professional property management. At SRWW, we have our own in-house management teams who are trained to uphold the standards of our brand.

This means your investment is in good hands from day one. With experienced property management in place, you can focus on enjoying the benefits of your investment, knowing your unit and its long-term value are being looked after with care and precision.

Upgrade Strategically

Enhancing your property with well-chosen upgrades is a smart way to increase its appeal, value, and long-term profitability. Thoughtful improvements, such as premium materials, smart technology integration, or customized design elements, can elevate the living experience without the need for a complete overhaul.

These upgrades aren’t about spending more, but about spending wisely to create a refined and functional space that resonates with discerning renters. In a competitive luxury market, strategic enhancements help your property stand out, attract the right audience, and command higher returns.

Offer Lifestyle-driven Amenities

These amenities go beyond the basics; they include features that elevate everyday living, such as wellness centers, private lounges, concierge services, sky gardens, and resort-style pools.

Today’s renters aren’t just looking for a place to stay, they’re seeking a seamless lifestyle experience. When your property offers conveniences and comforts that align with their values and routines, it naturally becomes more desirable and valuable.

Consider investing in or partnering with developments that are thoughtfully designed with this kind of living in mind. Choose properties that prioritize space, design, and curated experiences for their residents. When your investment offers more than just square footage, when it offers a lifestyle, it becomes a destination, not just a dwelling. That’s where real, lasting value is created.

Optimize Your Rental Pricing

Optimizing your rental pricing means setting a rate that reflects the true value of the property, considering location, design, amenities, and the overall living experience. It’s not about underpricing to compete; it’s about aligning your rate with market expectations and the unique character of your property.

A well-optimized rate reinforces the exclusivity of your unit, establishes it as part of a prestigious address, and helps maintain your investment’s brand integrity over time. To do this effectively, study the high-end rental market in your area.

Look at similar properties, assess what renters in this segment are willing to pay for lifestyle-enhancing features, and consider the timing of your listing. Market conditions, local demand, and property availability all play a role. By being intentional with your pricing, neither inflating it unrealistically nor undervaluing it, you create a competitive yet aspirational offering.

Key Takeaway

These tips for real estate investors to maximize ROI in rental, from choosing the right location to offering lifestyle-driven amenities and working with trusted developers, serve as a strong foundation for making well-informed decisions.

If you’re looking for a property that embodies these principles, Shang Residences at Wack Wack (SRWW) offers a distinguished investment opportunity in the heart of Mandaluyong. Contact us today to explore how investing in a high-end condominium can help you build a successful real estate portfolio.